Tata AIA Daily life shall have the best to claim, deduct, alter, Get better the amount of any applicable tax or imposition, levied by any statutory or administrative body, from the benefits payable beneath the Coverage. Kindly refer the gross sales illustration for the precise premium.

The overall performance of the managed portfolios and resources is just not guaranteed, and the value could increase or minimize in accordance with the future knowledge in the managed portfolios and funds.

It's going to seek to take a position in companies with similar weights as from the index and produce returns as carefully as possible, matter to monitoring mistake.

Tata AIA Param Raksha Lifetime Professional + is an extensive lifestyle insurance plan Option featuring detailed protection in conjunction with wealth creation Advantages. It offers versatile options for securing your family’s future though maximizing economical advancement through sector connected returns$.

The assorted resources provided beneath this contract tend to be the names with the funds and do not in any way reveal the standard of these plans, their long run potential clients and returns. On survival to the top in the coverage expression, the entire Fund Price such as Top rated-Up Premium Fund Worth valued at applicable NAV on the date of Maturity will probably be paid.

The Wellness$$ Software relies on details which you could gain by finishing on the web wellbeing assessments and by Assembly everyday and weekly physical activity goals.

The client is encouraged to refer the in depth sales brochure of respective personal merchandise outlined herein before concluding sale.

Relevant for department stroll in. Time limit to post declare to Tata AIA by 2 pm (Operating times). Subject matter to submission of finish paperwork. Not applicable to ULIP insurance policies and open title claims.

Tata AIA Life Insurance provider Ltd. isn't going to suppose responsibility on tax implications outlined any where on This page. Remember to speak to your individual tax expert to understand the tax Added benefits accessible to you.

ULIPs provide lifestyle insurance policies coverage as well as investment Added benefits. From the celebration of your policyholder's premature demise, the nominee receives the sum assured or the fund benefit, whichever is bigger.

In ULIP, a percentage of the high quality paid out through the policyholder is used for lifestyle insurance coverage protection, when the remaining total is invested in a variety of equity, personal debt or well balanced money as per the policyholder's desire.

Avail tax Rewards According to applicable tax legislation Flexibility to pick from click resources numerous major rated++ fund alternatives starting from equity to financial debt-oriented Affordable Premiums

4All Rates from the policy are special of applicable taxes, obligations, surcharge, cesses or levies that can be entirely borne/ paid out from the Policyholder, In combination with the payment of these kinds of Premium.

You should tick the Verify box to progress Nearly there! Your high quality calculation is in progress

ULIPs give the pliability of selecting between various money determined by the policyholder's possibility urge for food and share sector investment objectives. The policyholder can change involving distinctive funds as per their monetary targets and market place ailments.

The Phrase Booster6 is an additional function that enhances the protection within your coverage. In case the daily life insured is diagnosed using a terminal sickness, they'll receive ten% in the sum assured underneath the lifetime insurance plan policy.

ULIP means Unit Linked Insurance plan Plan, that's a style of insurance solution that combines the benefits of existence insurance policies and investment in one system.

ULIPs are appropriate for people who are seeking a protracted-phrase investment option While using the extra benefit of lifetime insurance policies protection. It is suggested that one really should very carefully Examine the ULIP prepare and its charges before purchasing it.

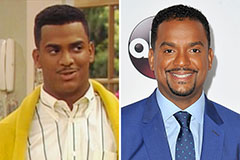

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!